OUR APPROACH

Investment Philosophy

At Pinnacle Elite, our investment philosophy is grounded in a commitment to delivering sustainable, long-term financial growth while minimizing risk. We believe that every investment journey is unique, and we customize our strategies to meet the specific goals of our clients.

Our approach is guided by :

-

Diversification

We focus on building a balanced portfolio across various asset classes, with a particular emphasis on alternative investments that offer higher potential returns.

-

Risk Management

We take a conservative yet opportunistic approach, ensuring that all investment decisions are carefully evaluated for both their growth potential and risk profile.

-

Client-Centered Strategies

Understanding the needs of STEM professionals is at the core of what we do. We develop personalized investment plans that align with both short-term goals and long-term wealth-building strategies.

Fund Structure

At Pinnacle Elite, our fund structure is designed to offer clarity, flexibility, and transparency to our investors. We employ a straightforward framework that allows for ease of entry while providing opportunities for scalability as your investment grows.

Key Features of Our Fund Structure :

-

Investment Tiers

We offer multiple tiers of investment to suit different capital levels, ensuring that all investors, from seasoned professionals to those just starting out, have access to suitable opportunities.

-

Pooled Investment Model

By leveraging a pooled investment structure, we offer investors access to larger, more lucrative projects that may not be available through individual investment. This structure enhances returns while reducing risk exposure.

-

Transparency

Investors receive regular, detailed updates on the performance of their investments. Our commitment to transparency ensures that you are always informed about how your capital is working for you.

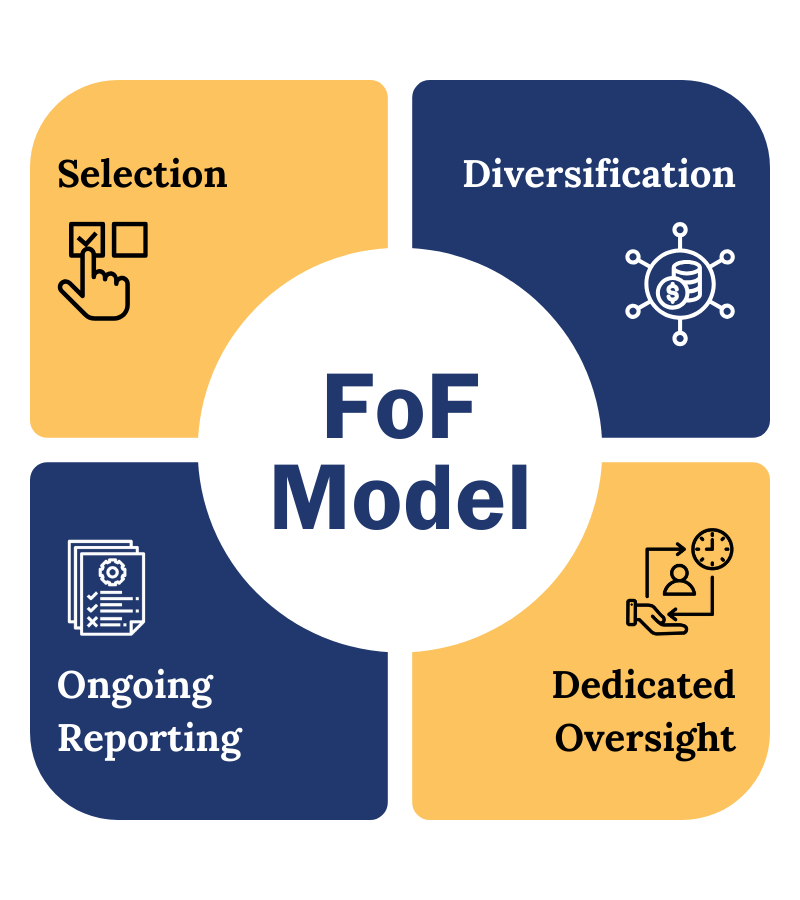

How the Fund of Funds (FoF) Model Works

At Pinnacle Elite, the Fund of Funds (FoF) model offers a streamlined and diversified approach to investing by pooling resources into a curated selection of top-performing real estate and private equity funds. This model allows investors to benefit from expert management and access a broader range of opportunities than they might individually.

How the Process Works :

-

Selection

We conduct a thorough evaluation of high-quality funds based on their performance history, management expertise, and alignment with your financial objectives.

-

Diversification

The selected funds collectively form a diversified portfolio, reducing risk by spreading investments across multiple sectors and asset types.

-

Ongoing Reporting

As a fund manager, we ensure that investors are regularly updated on the progress of their investments. This includes transparent communication, periodic performance updates, and timely delivery of tax-related documents, such as K-1 statements.

-

Dedicated Oversight

While investments are fixed once allocated, we maintain vigilant oversight of the underlying deals, ensuring they are progressing as planned. Our role is to provide clarity and confidence, keeping you informed every step of the way.